The Information Asymmetry Problem

Every negotiation involves information asymmetry. The question is: who has more?

What Your Supplier Knows:

- Every rebate they paid you for the past 5 years

- Your claim rate (submitted vs. available)

- Your claim timing (early, on-time, late, missed)

- Which mechanisms you consistently claim vs. ignore

- Your purchase patterns and threshold proximity

What You Probably Know:

- Your total spend with this supplier

- "We get rebates" (general awareness)

- Last year's payment (maybe)

According to World Commerce & Contracting, the average company loses 9% of contract value through poor management. That 9% includes negotiating without data - because you're essentially negotiating against yourself.

Your supplier's internal analysis before your meeting:

"They claimed €240K of the €400K available last year. Historical claim rate: 55-65%. Unlikely to push hard on improved terms because they can't demonstrate they're capturing current value."

That's not a negotiation. That's theater with a predetermined outcome.

The Credibility Gap: Asking for More While Leaving Money Behind

There's a fundamental credibility problem with asking for better terms when you haven't captured current terms.

The Conversation You Have:

"We'd like to discuss improving our rebate structure. We're a significant customer and believe we deserve better terms."

The Conversation Your Supplier Hears:

"We haven't bothered to claim 40% of current rebates, but we want you to give us more rebates that we also won't claim."

From the supplier's perspective:

- You're not price-sensitive (you leave money unclaimed)

- You're not operationally sophisticated (you can't track)

- You won't notice if terms get worse (you don't monitor)

According to Industry research, 40% of contract value leakage stems from execution failures - not negotiation failures. But poor execution undermines future negotiations.

You can't credibly demand better terms while demonstrating you can't manage current ones.

What Claim History Actually Reveals

Comprehensive claim history isn't just about knowing your numbers. It's about understanding your relationship dynamics.

Claim Rate Trend

Year 1: 55% captured

Year 2: 62% captured

Year 3: 71% captured

This tells a story: You're getting better at execution. You're paying attention. You're becoming a more sophisticated customer.

That trend alone changes the negotiation dynamic.

Missed Threshold Analysis

Year 1: Missed Tier 2 by €47K

Year 2: Missed Tier 3 by €12K

Year 3: Hit all tiers

This shows: You understand the structure. You're optimizing purchasing. You're capturing designed value.

Mechanism-Specific Performance

Volume rebates: 95% captured

Growth incentives: 80% captured

Product mix bonuses: 40% captured

Early payment: 25% captured

This reveals: Where you need better terms (product mix is too complex), where you need better internal processes (AP isn't capturing early payment), and where you're strong (volume tracking is working).

With this data, you negotiate specific improvements:

"We consistently hit volume tiers. The product mix bonus structure is too complex for practical tracking. We want to convert that 0.5% potential into a flat 0.3% on all purchases."

That's a credible, data-backed negotiation position.

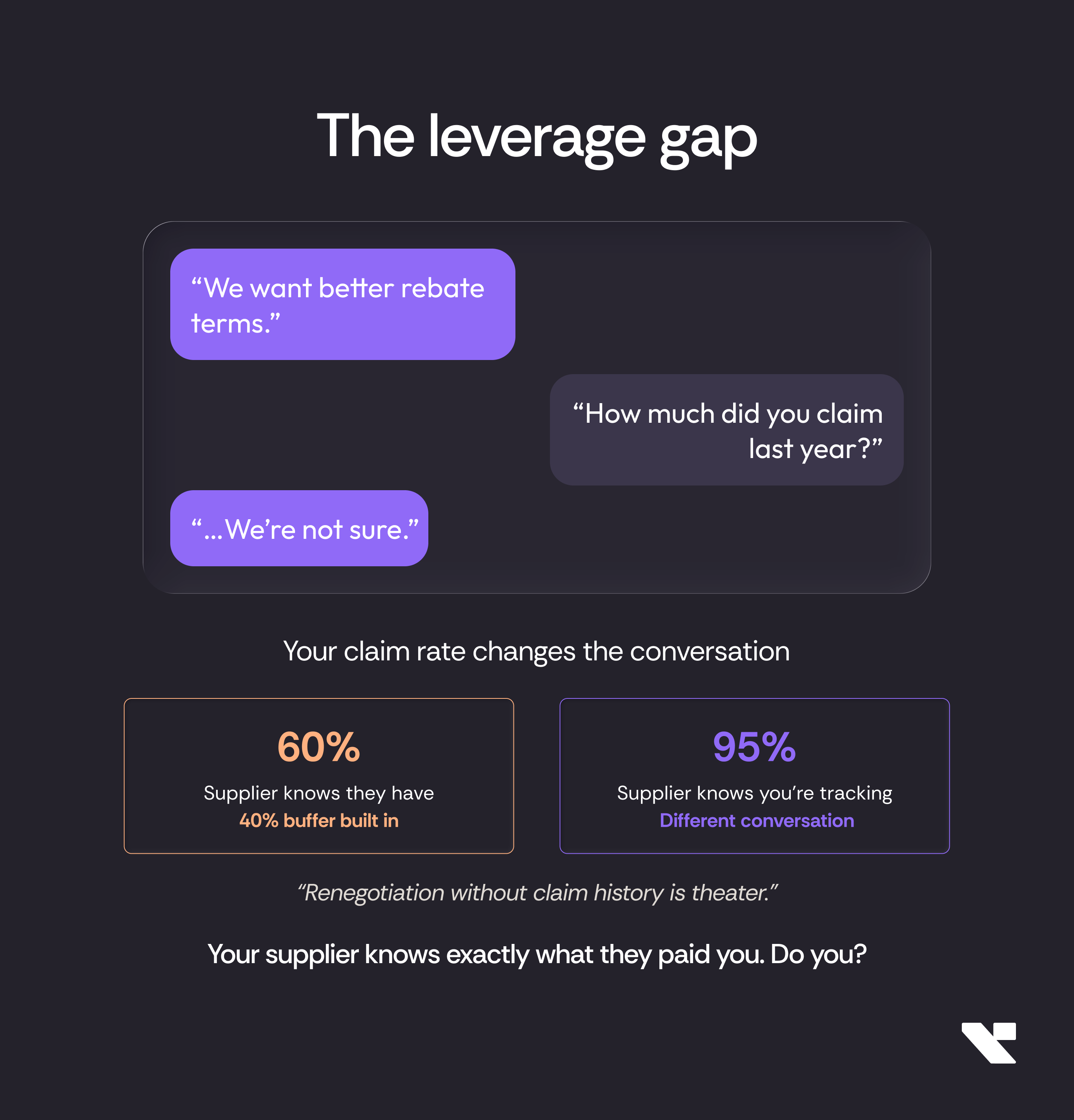

The Leverage Equation: Claim Rate = Negotiating Power

Scenario A: 60% Claim Rate

You captured €240K of €400K available.

Supplier's calculus: "They're leaving €160K on the table every year. If we give them 10% better terms, that's €40K more available - but at their capture rate, they'll only collect €24K of it. Net cost to us: minimal."

Your leverage: Low

Scenario B: 95% Claim Rate

You captured €380K of €400K available.

Supplier's calculus: "They're tracking everything. If we give them 10% better terms, they'll capture almost all of it. Net cost to us: real."

Your leverage: High

McKinsey research shows that organizations with strong contract execution capture 3-5% more value than those with weak execution. Part of that gap is direct capture. Part of that gap is better negotiated terms - because high performers negotiate from strength.

Claim rate isn't just about capturing current value. It's about positioning for future value.

The Data Package: What Best Teams Bring to Negotiations

Best-in-class procurement teams walk into negotiations with a comprehensive data package.

Historical Performance

- 3-year claim history by mechanism

- Capture rate trend

- Total available vs. total claimed

- Comparison to supplier's stated averages (if known)

Threshold Analysis

- Tiers hit vs. missed

- Proximity analysis (how close to next tier)

- Structural barriers identified

Mechanism Evaluation

- Which incentives work (high capture rate)

- Which are impractical (low capture rate)

- Proposed simplifications or restructures

Forward Projection

- Expected volume next term

- Growth trajectory

- Category mix evolution

With this package, you can make specific asks:

- "We hit Tier 3 in 2 of 3 years but missed by small margins in Year 2. We want the threshold lowered by 5% or the claim window extended."

- "The product mix calculation is too complex - we've captured only 40% of available value. Convert to a simpler structure or eliminate."

- "Our early payment capture is low because AP cycles don't match your terms. Extend the discount window from 10 to 15 days."

Each ask is backed by data. Each ask has a clear rationale. Each ask demonstrates sophistication.

The Preparation Gap: How Long Before You Can Answer?

Here's a diagnostic question:

How long would it take your team to compile a complete claim history for your top 5 suppliers?

If the answer is "a few hours":

You have basic visibility. Room for improvement, but you're not flying blind.

If the answer is "a few days":

You're typical. Data exists but it's scattered. Compilation is manual. You can prepare for important negotiations but not for all of them.

If the answer is "I'm not sure" or "we'd need to request data from the supplier":

You have a serious visibility gap. You're negotiating without leverage.

According to PwC research, 90% of professionals struggle to locate contracts when needed. Claim history is even harder - it requires connecting contract terms to historical payments to ERP data.

Before your next supplier negotiation, pull your claim rate for the past 3 years.

If you can't get that number in 24 hours, you're not ready to negotiate.

The Business Case: Informed vs. Blind Negotiations

Scenario: €5M annual supplier, 3-year contract renewal

Blind Negotiation (No Claim History):

- Generic request for "better terms"

- Supplier offers token improvement (0.25% additional)

- You accept because you can't argue

- 3-year value: €37.5K additional

Informed Negotiation (Complete Claim History):

- Data-backed analysis of current capture

- Specific requests for practical improvements

- Structural changes that increase actual capture rate

- Supplier offers meaningful improvement (0.75% additional)

- 3-year value: €112.5K additional

Value Gap: €75K over 3 years - on one supplier.

Now multiply across your supplier portfolio.

Aberdeen Group research shows that best-in-class companies achieve 56% higher contract performance than their peers. A significant portion of that gap comes from negotiating with data rather than negotiating with hope.

Before Your Next Negotiation: Get the Data

Your supplier knows:

- Every rebate they've paid you

- Your claim rate

- Your patterns and gaps

Do you?

If you're entering a negotiation without matching their information advantage, you've already lost ground before the conversation starts.

The minimum viable preparation:

- Total available rebates for past 3 years

- Total claimed rebates for past 3 years

- Claim rate by mechanism

- Missed thresholds and margins

- Mechanism-specific challenges

If you can't compile this in 24 hours, delay the negotiation.

Better to postpone than to negotiate blind.

Better to know your position than to guess it.

Better to have data than to have hope.

"We want better rebate terms."

"How much did you claim last year?"

Make sure you have the answer. The real one. The one backed by data.

That's the difference between negotiation and theater.