For CFOs and Procurement leaders, this represents a critical gap in contract value management that directly impacts the bottom line.

The Scale of the Problem: Billions Lost Annually

This isn't a minor operational inconvenience. It's a systemic failure costing businesses billions.

The research from leading consulting firms is unambiguous:

Deloitte and DocuSign's 2025 Digital Agreement Management Study quantified the global impact: poor contract management costs businesses $2 trillion per year globally - expected to rise to $2.3 trillion by 2030. A significant portion stems from missed deadlines and forfeited claims.

According to World Commerce & Contracting and Deloitte research, the average company loses 19% of contract value through mismanagement. Best-in-class organizations limit this to 3-7%, while underperformers lose over 25%.

McKinsey's 2025 procurement research confirms these findings: contract value leakage quietly drains significant value every year - not from poor negotiations, but from what happens after the ink dries: missed rebates, unclaimed volume discounts, and unmanaged renewals.

For context: if your company manages €20 million in supplier contracts, even the conservative end of that range means €1 million in annual leakage - much of it from deadlines that simply weren't tracked.

The Aberdeen Group found that best-in-class companies achieve a 56% higher contract renewal rate compared to their peers, directly attributable to systematic reminder processes. That performance gap translates to millions in captured value.

Time Savings with Proper Contract Intelligence

Research quantifies what automated contract deadline tracking and rebate management delivers:

| Process | Time Savings | Source |

|---|---|---|

| Manual bonus/rebate administration | ~50% reduction | Aberdeen: "Contracting cycles cut in half" |

| Negotiation preparation | ~40% reduction | BCG: "Time on negotiations declined 30%+" |

| Search & versioning | ~60% reduction | Forrester: "60% improvement in efficiency" |

Beyond time savings, proper rebate management delivers a minimum 3% bonus optimization. McKinsey confirms organizations recover 3-5% of contract value through systematic contract intelligence - value that disappears when deadlines are missed.

The question isn't whether your company is losing money to missed deadlines and contract value leakage. The question is how much - and whether you even know.

Where Deadline Failures Actually Happen

Let's be specific about the failure points.

Rebate Claim Windows

Most supplier rebate agreements include claim deadlines - typically 30, 60, or 90 days after the qualifying period ends. Miss the window, and you forfeit the rebate.

Common failure scenarios:

- Holiday timing: Deadline falls during vacation period or long weekend

- Staff turnover: The person who "owned" that deadline left six months ago

- Documentation gaps: You knew about the deadline but couldn't compile proof in time

- Calendar confusion: Contract says "Q4" but doesn't specify fiscal vs. calendar year

Auto-Renewal Traps

Research that approximately half of vendors with auto-renewal provisions do not send advance notice.

A company with 10 locations, each on a €500/month contract, could face over €90,000 in fees if they cancel 6 months into a 24-month auto-renewal they didn't intend to trigger.

Price Adjustment Deadlines

According to McKinsey, clauses that cap pricing adjustments were not included in nearly 40% of contracts reviewed. Even when protective clauses exist, invoking them requires action within defined timeframes.

Why Calendar Reminders Don't Work

The standard response to deadline management: "We'll put it in the calendar."

Here's why that fails at scale.

Volume Overwhelms Attention

The average enterprise manages hundreds of active contracts. According to Gartner, the average company uses 110 different software applications - each with associated contracts and deadlines.

Calendar reminders work for five appointments. They don't work for 500 contract obligations.

Context Gets Lost

A calendar reminder says: "Supplier X rebate deadline."

It doesn't say what the terms are, what documentation is required, what your qualifying purchases total, or what the claim process involves.

Ownership Is Unclear

Research indicates that 71% of businesses can't locate at least 10% of their contracts. If you can't find the contract, you can't manage its deadlines.

Human Error Is Inevitable

PwC research found that 90% of professionals struggle to locate contracts when needed. The system fails because it depends on perfect human attention - which doesn't exist.

The Compounding Cost of Deadline Failures

Missed deadlines don't just cost immediate value. They create cascading consequences.

Direct Financial Loss

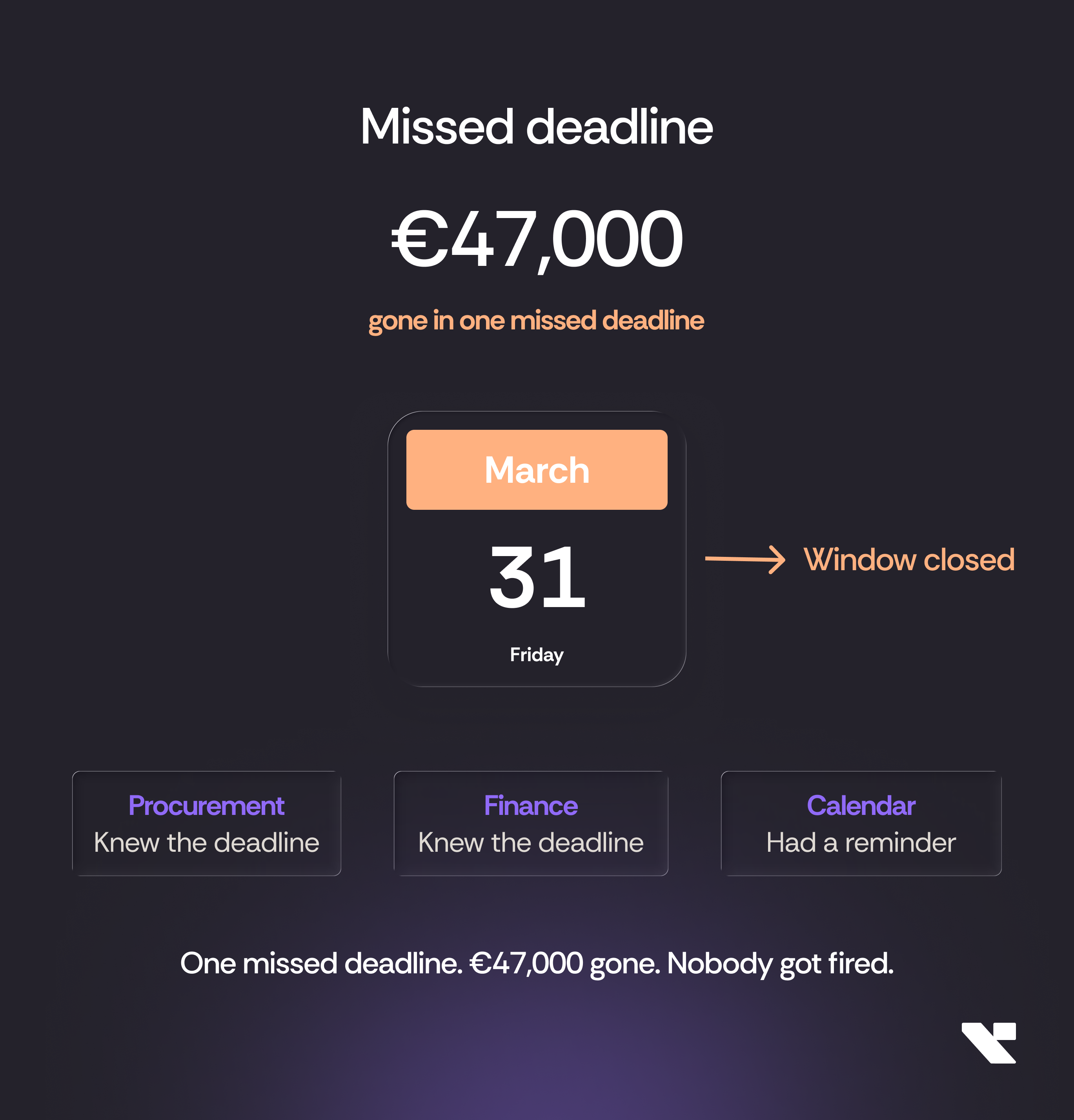

The €47,000 in our opening story is the obvious cost. Multiply across your supplier portfolio: five suppliers with similar claim windows, 1-2 missed deadlines per year = €100,000-€250,000 in annual leakage.

Weakened Negotiating Position

Your supplier knows exactly what they paid you. If your claim rate is 60%, they know they have a 40% buffer built into the deal. That's not negotiation. That's theater.

Operational Disruption

Research these shadow costs accumulate: a missed renewal triggers emergency procurement, which disrupts cash flow, which delays strategic initiatives.

Compliance and Audit Risk

In regulated industries, contract deadline failures create compliance exposure. World Commerce & Contracting notes that contract failures are increasingly appearing in audit findings.

What Systematic Deadline Management Looks Like

The alternative to calendar chaos is systematic contract intelligence.

Centralized Obligation Tracking

Every deadline, claim window, renewal date extracted from contracts and stored in a structured system - not buried in PDF paragraph 14.3.

Automated Alerts with Context

Not "Supplier X deadline in 30 days." Instead: "Supplier X Q3 rebate claim window opens in 30 days. Current qualifying purchases: €1.2M. Required documentation: quarterly purchase summary. Historical claim rate: 85%."

Ownership Assignment

Every obligation has a designated owner. PwC and World Commerce & Contracting research shows organizations implementing systematic management experience an 80% reduced risk rate in compliance failures.

Portfolio-Level Visibility

See all upcoming deadlines across your entire contract portfolio. Filter by supplier, category, deadline type, or risk level.

Integration with Operational Data

When the rebate claim window opens, qualifying purchase data should already be compiled. When threshold approaches, you know before the deadline - not after.

The Business Case: Prevention vs. Recovery

Let's be concrete about the economics.

Scenario: Mid-sized manufacturer, €40M annual supplier spend, 60 major contracts

Current state (calendar-based tracking):

- Average missed deadlines per year: 8-12

- Estimated value forfeited: €150,000-€300,000 annually

- Staff time on deadline firefighting: 200+ hours/year

- Audit findings: 2-3/year

After systematic deadline management:

- Missed deadlines: Near zero

- Value recovery: 95%+ of available claims captured

- Staff time redirected to strategic work

- Audit findings: Eliminated

Aberdeen Group research demonstrates that the 56% improvement in contract renewal rates achieved by best-in-class organizations translates directly to captured value.

On €40M in contracts, that's €1.2M-€2M in recovered value - from deadlines that would otherwise have passed unnoticed.

How Vendortell delivers contract intelligence in practice

Vendortell brings together vendor and customer management, contract management, incentives, tasks and analytics in one platform.

One backbone for vendors and customers

- Each vendor and customer has a single, shared profile across the organization.

- All contracts, addenda and related documents are linked to that profile.

- Ownership is clear: you can see who is responsible for each relationship.

Contract management with real intelligence

Vendortell does not just store PDFs. It:

- Extracts and structures key terms based on document type.

- Links each clause or concept back to the exact place in the source contract.

- Creates summaries that non-legal stakeholders can understand and act on.

This means:

- Procurement sees negotiated incentives and how they are actually used.

- Finance sees exposure, indexation mechanisms and commercial risks.

- Legal sees how standard and non-standard clauses are distributed across the portfolio.

Incentive management

- Volume bonuses, rebates, penalties and performance based incentives are captured as data.

- Vendortell can track whether conditions are met and whether the incentive has been claimed.

- Upcoming opportunities and risks are surfaced proactively.

For many customers, this is where significant “hidden” upside is found.

In categories with high spend and complex incentives, it is common to uncover six- to sevenfigure value in the first year, not by renegotiating harder, but by finally seeing and using what was already agreed.

Task and workflow management

- Indexation windows, renewal deadlines and governance obligations trigger tasks automatically.

- Crossfunctional workflows ensure Legal, Procurement, Sales and Finance are aligned on renegotiation strategy and approvals.

- Nothing is left to memory or individual spreadsheets.

Analytics and portfolio views

- Dashboards give CFOs and CPOs a portfoliolevel view of spend, exposure and opportunities.

- Outliers and structural issues are highlighted: Non-standard clauses, off- benchmark pricing, underused incentives.

- Q4 preparation becomes a guided, datadriven process.

“Ask Vendortell”

- Natural-language search lets users ask questions directly:

- “Show me all contracts with autorenewal in the next six months over €100k.”

- “Which vendor contracts include volume rebates we have not used?”

- Answers are grounded in the structured contract data and link back to source documents.

Conclusion: Stop losing value in silence

Contracts are among the most valuable, yet least digitised assets in modern organizations.

Q4 renegotiations do not create this reality, they simply shine a light on it.

Traditional CLM has taken organizations part of the way by digitalising documents and workflows. But as long as contracts remain static PDFs, you will keep:

- Negotiating on fragments instead of facts.

- Leaving incentives and protections unused.

- Discovering risks and opportunities too late.

If you walk into Q4 without a Contract Intelligence Spine, you are choosing to leak value.

Vendortell gives you a different option:

- Turn your contract landscape into a living, AI-ready financial asset.

- Break the Contract Value Leakage Loop.

- Move up the Contract Intelligence Maturity Curve, from PDF chaos to portfolio-level control and, ultimately, AI-enabled optimization.

A concrete next step:

You do not need a multi year transformation project to see if this works.

Start with something simple and with high impact:

- Pick one strategic spend category or your top 20 vendor contracts.

- Bring them into Vendortell.

- In 30-60 days, measure how much previously invisible value, risk and opportunity we surface.

From there, you decide how far and how fast to scale.

Stop losing value in silence. Start treating contracts as the financial assets they really are.