The Real Cost of Poor Contract Management

The numbers from leading consulting firms are clear - and staggering.

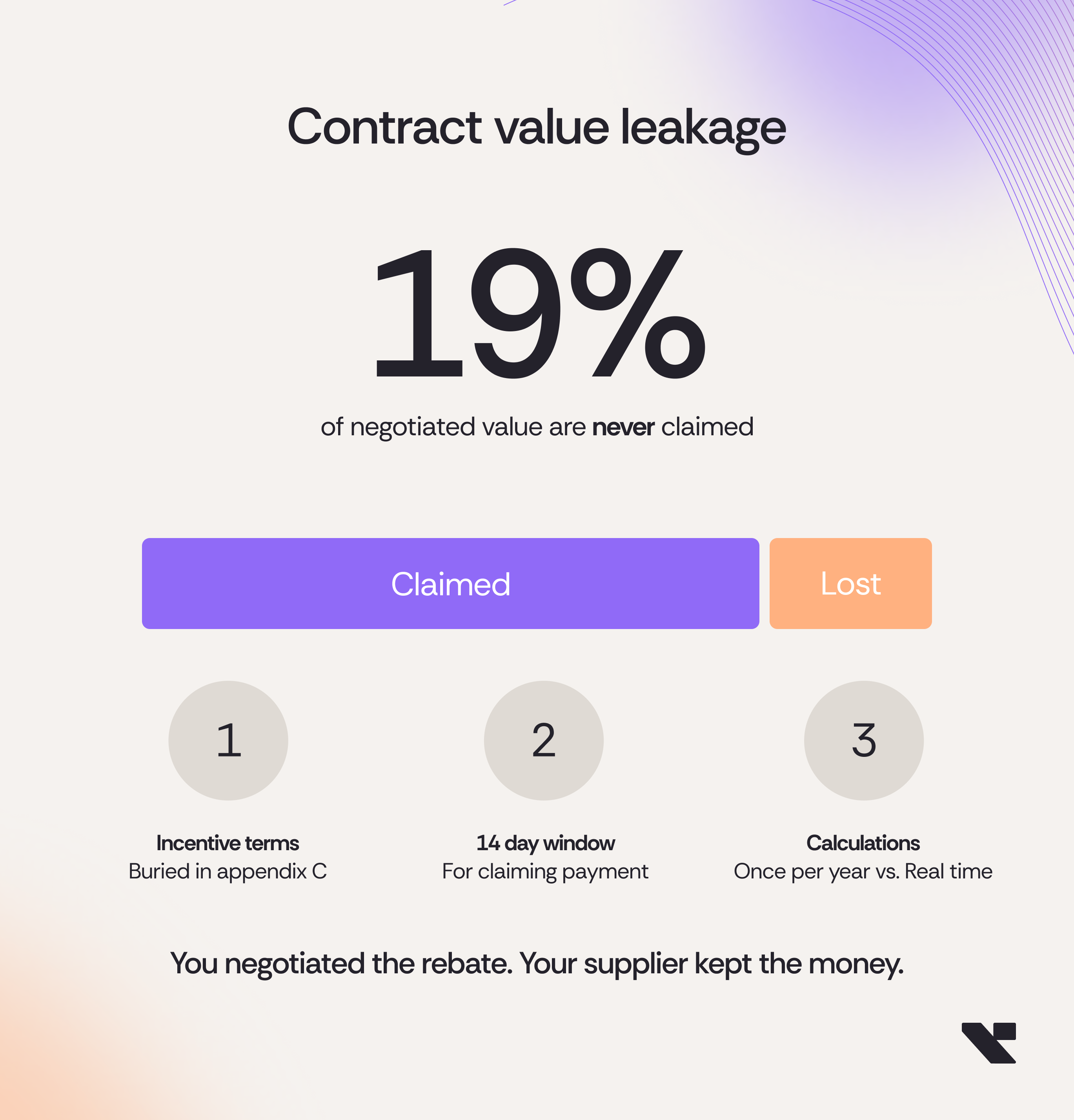

According to World Commerce & Contracting and Deloitte research, the average company loses 19% of contract value through mismanagement. Best-in-class organizations limit this to 3-7%, while underperformers lose over 25% and up towards 50%.

McKinsey's 2025 research on procurement value leakage confirms these findings, identifying multiple sources of leakage: purchasing orders not matching preferred supplier contracts (costing 5-15%), no preauthorization or slow payment (costing 5-10%), and limited spend visibility (costing another 5-10%).

For a company with €50 million in supplier contracts, that's €9.5 million in potential annual leakage.

Deloitte and DocuSign's 2025 Digital Agreement Management Study quantified the global impact: poor contract management costs businesses $2 trillion per year globally - expected to rise to $2.3 trillion by 2030.

But here's what most executives miss: the majority of this leakage doesn't happen at the negotiation table. It happens after the contract is signed.

Time Savings with Contract Intelligence & Rebate Management

Research from leading consulting firms quantifies what proper rebate management software delivers:

| Process | Time Savings | Source |

|---|---|---|

| Manual bonus/rebate administration | ~50% reduction | Aberdeen: "Contracting cycles cut in half" |

| Negotiation preparation | ~40% reduction | BCG: "Time on negotiations declined 30%+" |

| Search & versioning | ~60% reduction | Forrester: "60% improvement in efficiency" |

Beyond time savings, proper contract intelligence delivers a minimum 3% bonus optimization. McKinsey confirms organizations recover 3-5% of contract value through systematic rebate tracking and supplier rebate management.

Deloitte's research on post-signature contract management reveals that almost 70% of the costs of contract management are incurred post-award. Yet this is precisely the phase where most organizations invest the least attention in rebate management.

The problem isn't that you negotiate bad deals. The problem is that you don't capture what you negotiated - a core function of proper contract intelligence.

Where Rebate Value Actually Disappears

Let's be specific about where the money goes.

Volume Tier Thresholds

Your contract says: "3% rebate at €1M annual spend, 5% at €2M."

Your YTD spend: €1.87M with six weeks left in the year.

Your awareness of this: Zero.

Because the contract lives in SharePoint, spend lives in SAP, and nobody connected the two.

Push €130K in orders forward, and you unlock an additional 2% on your entire annual spend. Miss it, and you leave €37K+ on the table.

McKinsey found that 80% of procurement functions are not fully aware of competitive terms and contract structure.

Early Payment Discounts

The contract offers 2% for payment within 10 days.

Finance processes invoices in 14 days on average.

Over 200 invoices per year, that's a 2% discount you qualified for but never took.

Growth and Performance Rebates

Your contract includes a 1.5% rebate for YoY growth exceeding 5%.

Your growth this year: 7.2%.

Your claim: Nothing.

Because calculating growth requires pulling last year's figures, comparing to this year's purchases, validating the methodology matches the contract definition, and submitting documentation within the claim window.

Nobody owns this. So nobody does it.

Why Traditional Contract Management Fails Here

Most organizations have made progress digitizing contracts:

- PDFs stored in a CLM or document management system

- E-signatures deployed

- Templates and playbooks standardized

This is positive. But it solves the wrong problem.

Traditional contract management answers: "Where is the contract?"

It doesn't answer:

- What rebate tiers exist across my supplier portfolio?

- How close am I to hitting the next threshold?

- Which claims need to be submitted this quarter?

- What's my earned-but-unclaimed value right now?

According to Deloitte, 50% of CLM implementations fail to meet expectations, with most failures occurring in the post-signature phase.

Forrester describes this gap directly: contracts are the bridge between strategy and reality. But if your contract system only manages documents, that bridge has a hole in it - and value falls through.

The Contract Value Leakage Loop

We see the same pattern in every organization we work with. It's a loop that repeats annually:

Stage 1: Fragmented Reality

Contracts are scattered across systems, geographies, and teams. Key terms aren't structured. Incentives aren't linked to operational data. No one has a complete picture.

Stage 2: Time-Pressured Periods

Q4 hits. Renewals pile up. Claims come due. Teams scramble with partial information, chasing PDFs and building spreadsheets from scratch.

Stage 3: Sub-Optimal Outcomes

Negotiations and claims are based on fragments: a PDF here, a few invoices there, someone's memory of what was agreed. Upside is missed. Deadlines slip.

Stage 4: Weak Follow-Through

New agreements are signed, but incentives, obligations, and deadlines aren't systematically tracked. The cycle resets with the same gaps.

Then the loop repeats.

McKinsey's research quantifies this: the average procurement savings pipeline loses one-third of its estimated value in the planning stages and another 20% in execution.

The value was negotiated. The value was agreed. The value was never captured.

What Contract Intelligence Actually Means

Contract intelligence means treating each contract as a structured, connected, living asset - not a static document.

In practice:

Extraction and Structure

Key terms, prices, incentives, thresholds, and claim requirements are automatically captured as data. Not buried in paragraph 7.3 of a 40-page PDF.

Connection to Reality

Contracts are linked to vendors, spend data, invoice flows, and performance metrics. When your purchases cross a threshold, the system knows.

Portfolio Visibility

You can see exposure and opportunity not just per contract, but across categories, vendors, and business units.

Automated Workflows

Tasks, reminders, and escalations trigger automatically when conditions are met.

AI-Powered Analysis

Ask questions in natural language. Get answers grounded in actual contract terms and operational data.

One global pharmaceuticals company used an AI-based invoice-to-contract reconciliation tool. According to McKinsey, a proof of concept developed in just four weeks identified more than $10 million in value leakage.

The technology exists. The question is whether you're using it.

The Business Case: What Recovery Looks Like

Let's be concrete.

Scenario: Mid-sized distributor, €75M annual supplier spend, 45 major vendor contracts

Current state:

- Rebate tracking: Excel spreadsheets, updated quarterly

- Claim rate: ~81% (19% leakage)

- Typical unclaimed value: €285,000 annually

After implementing contract intelligence:

- Rebate tracking: Automated, linked to ERP spend data

- Claim rate: 95%+

- Recovered value: €200,000+ annually

The ROI isn't theoretical. It's money that was already negotiated, already earned, and already owed to you.

Research from Deloitte shows that average contract value leakage has fallen from 9.2% to 8.6% over the past decade for organizations that invested in post-signature management.

CPO expectations for digital procurement include a 50% reduction in value leakage. That's not aspirational. It's achievable.

The Contract Intelligence Maturity Curve

Most organizations underestimate how much structural value they lose as long as contracts remain static documents.

The Contract Intelligence Maturity Curve describes five levels of maturity:

Level 1: PDF Chaos

- Contracts are stored as PDFs in shared drives and emails.

- No central overview of vendors, dependencies or incentives.

- Q4 renegotiations are driven by inbox searches and individual spreadsheets.

Level 2: Basic CLM

- Contracts are stored in a CLM with search, templates and e-signature.

- Expiry and renewal dates are tracked.

- Some metadata is captured, but often manually and inconsistently.

This is a step forward, but the economic reality of the contracts is still opaque.

If your current CLM mainly answers “where is the contract?” and “when does it expire?”, you’re at Level 2.

Level 3: Contract Intelligence Backbone

- Contracts are systematically structured and linked to vendors, customers and categories.

- Key terms, incentives, risks and obligations are extracted.

- Spend and performance data are connected where possible.

- Q4 renegotiation packs is generated based on facts, not fragments.

Level 4: Portfolio Level Intelligence

- You can see exposure and opportunity across the contract portfolio.

- Scenario analysis is possible: “What happens to our P&L if we renegotiate the top 20 vendor contracts by 2%?”

- Outliers, patterns and structural issues are surfaced automatically. At Level 4, Q4 becomes a strategic exercise instead of a firefight.

Vendortell is built to get organizations to the start of Level 4 quickly and always by leveraging existing contracts and systems rather than ripping everything out.

Level 5: AI Enabled Agents and Co-Pilots

- AI agents continuously scan your contract and spend data for risks and opportunities.

- Agents proactively propose actions: “These five contracts should be repriced based on current indices” or “You are missing rebates for this vendor.”

- Agents can prepare negotiation packs, simulate scenarios and suggest alternative terms based on your playbooks and market input.

McKinsey’s work on AI in procurement shows how digital and AI capabilities can materially reduce value leakage and increase throughput per FTE, reinforcing the direction of this Level 5 vision. McKinsey

Vendortell is already building towards this level, with structured AI functionality and integration options that allow AI agents to work directly on structured contract data instead of PDFs.

The critical point is this:

You do not have to jump from Level 1 to Level 5 overnight.

But staying at Level 1-2 is now a strategic choice to keep leaking value.

Vendortell is the practical way to move into Level 3-4, and to prepare for Level 5 safely.

How Vendortell delivers contract intelligence in practice

Vendortell brings together vendor and customer management, contract management, incentives, tasks and analytics in one platform.

One backbone for vendors and customers

- Each vendor and customer has a single, shared profile across the organization.

- All contracts, addenda and related documents are linked to that profile.

- Ownership is clear: you can see who is responsible for each relationship.

Contract management with real intelligence

Vendortell does not just store PDFs. It:

- Extracts and structures key terms based on document type.

- Links each clause or concept back to the exact place in the source contract.

- Creates summaries that non-legal stakeholders can understand and act on.

This means:

- Procurement sees negotiated incentives and how they are actually used.

- Finance sees exposure, indexation mechanisms and commercial risks.

- Legal sees how standard and non-standard clauses are distributed across the portfolio.

Incentive management

- Volume bonuses, rebates, penalties and performance based incentives are captured as data.

- Vendortell can track whether conditions are met and whether the incentive has been claimed.

- Upcoming opportunities and risks are surfaced proactively.

For many customers, this is where significant “hidden” upside is found.

In categories with high spend and complex incentives, it is common to uncover six- to sevenfigure value in the first year, not by renegotiating harder, but by finally seeing and using what was already agreed.

Task and workflow management

- Indexation windows, renewal deadlines and governance obligations trigger tasks automatically.

- Crossfunctional workflows ensure Legal, Procurement, Sales and Finance are aligned on renegotiation strategy and approvals.

- Nothing is left to memory or individual spreadsheets.

Analytics and portfolio views

- Dashboards give CFOs and CPOs a portfoliolevel view of spend, exposure and opportunities.

- Outliers and structural issues are highlighted: Non-standard clauses, off- benchmark pricing, underused incentives.

- Q4 preparation becomes a guided, datadriven process.

“Ask Vendortell”

- Natural-language search lets users ask questions directly:

- “Show me all contracts with autorenewal in the next six months over €100k.”

- “Which vendor contracts include volume rebates we have not used?”

- Answers are grounded in the structured contract data and link back to source documents.