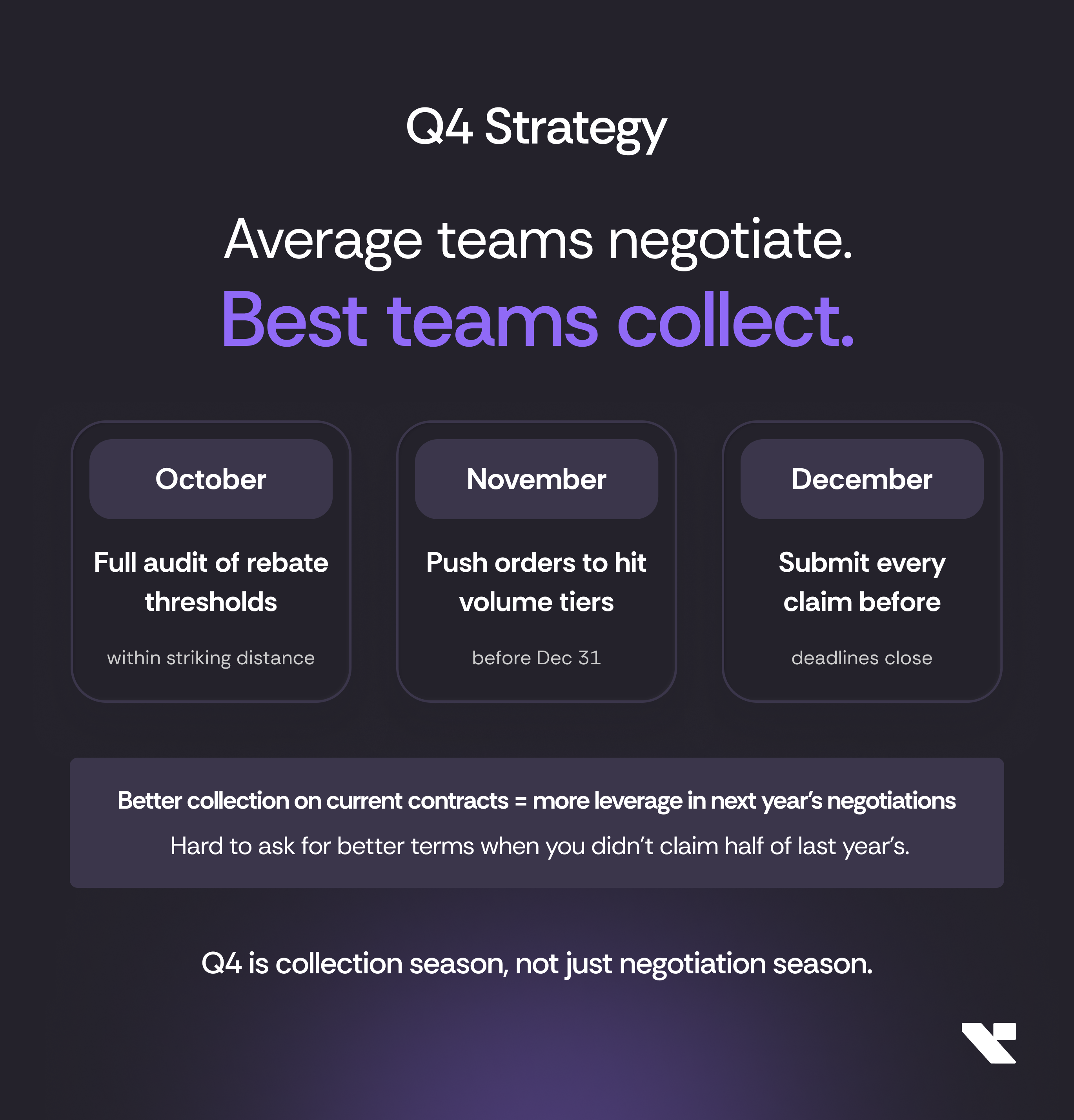

The Q4 Divide: Collectors vs. Negotiators

There are two types of procurement organizations in Q4.

Type 1: The Negotiators

Focus: Next year's contracts

- Calendar full of renewal meetings

- Drafting RFPs and reviewing proposals

- Negotiating new terms for January start

- Current year contracts? "We'll reconcile in January"

Type 2: The Collectors

Focus: This year's value

- October: Threshold audit across entire portfolio

- November: Strategic purchasing to hit remaining tiers

- December: Systematic claim submission

- January: Enter negotiations with clean claim history

According to Aberdeen Group research, best-in-class companies achieve a 56% higher contract renewal rate compared to their peers. That gap isn't about negotiating skill - it's about execution discipline.

You can't negotiate effectively while leaving current money uncollected.

The October Audit: Finding Money Before It Expires

Best-in-class procurement teams start Q4 with a comprehensive threshold audit.

The October Questions:

- Which rebate thresholds are we within 15% of hitting?

At €850K YTD spend with a €1M tier? That's a target, not a hope. - What claim windows close before year-end?

Annual rebates with December 31 deadlines. Quarterly bonuses with January cutoffs. - Which early payment discounts are we not taking?

2/10 net 30 terms that AP is ignoring because nobody told them. - What growth bonuses have we triggered but not documented?

YoY increase above 10%? That's often worth an additional 1-2%.

According to World Commerce & Contracting, organizations lose an average of 9% of contract value through poor management. The October audit is about finding that 9% before December 31.

You can't collect what you haven't identified.

The November Push: Strategic Purchasing for Value

November is about execution - turning threshold proximity into threshold achievement.

The November Tactics:

Accelerate Planned Purchases

Q1 purchases that could happen in December? Move them forward.

The math: If you're at €920K with a 3% tier at €1M, pulling forward €80K in January purchases earns you €30K in rebate (3% on €1M) vs. €27.6K (3% on €920K).

That €80K acceleration earns €2,400 extra. Cost: zero.

Consolidate Split Spending

Three business units buying from the same supplier? Consolidate for threshold purposes.

€300K + €350K + €400K separately = no tier hit.

€1.05M consolidated = tier 2 achieved.

Early Payment Window Capture

2% discount for payment in 10 days vs. net 30? On €500K in November invoices, that's €10K in free money.

But AP needs to know which invoices qualify. November is when procurement communicates.

McKinsey research shows that organizations practicing proactive contract management capture 3-5% more value than reactive organizations. November is where proactive happens.

The December Deadline: Claims Before Close

December is the finish line. Every unclaimed rebate, every unused right, every unexpired deadline - December is when it either gets captured or gets lost.

The December Checklist:

Rebate Claims Submitted

Every earned rebate documented and submitted:

- Volume thresholds achieved → claim filed

- Growth bonuses triggered → calculation submitted

- Product mix targets met → documentation complete

Performance Credits Claimed

Supplier underperformance during the year? SLA misses? Delivery failures?

December is when those credits get claimed - before they expire.

Expiring Rights Exercised

Price benchmarking rights that expire at year-end?

Renegotiation windows that close on December 31?

Use them or lose them. December is the last chance.

Next Year Foundations Set

Clean documentation of:

- Total available vs. total claimed

- Capture rate by supplier

- Missed opportunities and why

This becomes leverage for January negotiations.

Why Collection Beats Negotiation for Leverage

Here's the counterintuitive truth: better collection improves your negotiating position.

The Supplier's Perspective:

When you sit down to renegotiate, your supplier knows exactly what they paid you last year. They have the data.

- If your claim rate was 60%, they know they have a 40% buffer built in

- If your claim rate was 95%, they know you're tracking

Different conversations entirely.

The Data Advantage:

Walking into negotiations with:

- Complete claim history for the past 3 years

- Total available vs. total captured

- Specific missed thresholds and by how much

- Performance data matched to contract terms

That's not just information. That's leverage.

"We hit 94% of available rebates. We want terms that make it 100%."

vs.

"We want better rebates." "How much did you claim last year?" ". We're not sure."

Industry research confirms: 40% of contract value leakage stems from execution failures, not negotiation failures. Fix execution first, then negotiate from strength.

The Q4 Playbook: Week by Week

October Week 1-2: Portfolio Audit

- Pull all supplier contracts with incentive structures

- Map current YTD spend against all thresholds

- Identify "within striking distance" opportunities

- Flag all December 31 / Q4 claim deadlines

October Week 3-4: Action Planning

- Calculate threshold gaps and purchase requirements

- Coordinate with business units on Q1 pull-forward potential

- Brief AP on early payment discount priorities

- Assign claim preparation ownership

November Week 1-2: Execution Start

- Release accelerated purchase orders

- Begin rebate claim documentation

- Track threshold progress weekly

- Escalate any blockers

November Week 3-4: Documentation Push

- Complete all claim calculations

- Gather supporting documentation

- Pre-submit where suppliers allow

- Final threshold gap assessment

December Week 1-2: Submission Deadline

- Submit all rebate claims

- File performance credit claims

- Exercise expiring rights

- Document everything for January negotiations

December Week 3-4: Clean-Up and Prep

- Verify claim receipts

- Compile year-end capture report

- Build negotiation data packages

- Set Q1 collection calendar

The Metrics That Matter

Best-in-class procurement tracks Q4 differently.

Average Procurement Metrics:

- Cost savings negotiated

- Number of contracts renewed

- Cycle time to signature

Best-in-Class Q4 Metrics:

- Capture Rate: Rebates claimed ÷ rebates available

- Threshold Achievement: Tiers hit ÷ tiers within reach

- Claim Timing: Average days before deadline submitted

- Value at Risk: Unclaimed value with approaching deadlines

According to Gartner research, leading procurement organizations have moved from "savings" metrics to "value capture" metrics - measuring what's actually collected, not what's theoretically negotiated.

The shift:

Stop measuring what you negotiated. Start measuring what you captured.

What's Your Q4 Collection Plan?

If you don't have one, start with this:

List every rebate threshold you're within 10% of hitting.

If you can't generate that list in 30 minutes, you have a visibility problem.

If you can generate it but no one is acting on it, you have an execution problem.

If you're acting on it but still missing claims, you have a systems problem.

Best-in-class procurement doesn't happen by accident.

It happens because someone decided that Q4 is collection season - and built the processes, assigned the ownership, and tracked the metrics to make it real.

Average teams negotiate in Q4.

The best ones collect.

Which one are you?