The Disconnect: Transactions vs. Obligations

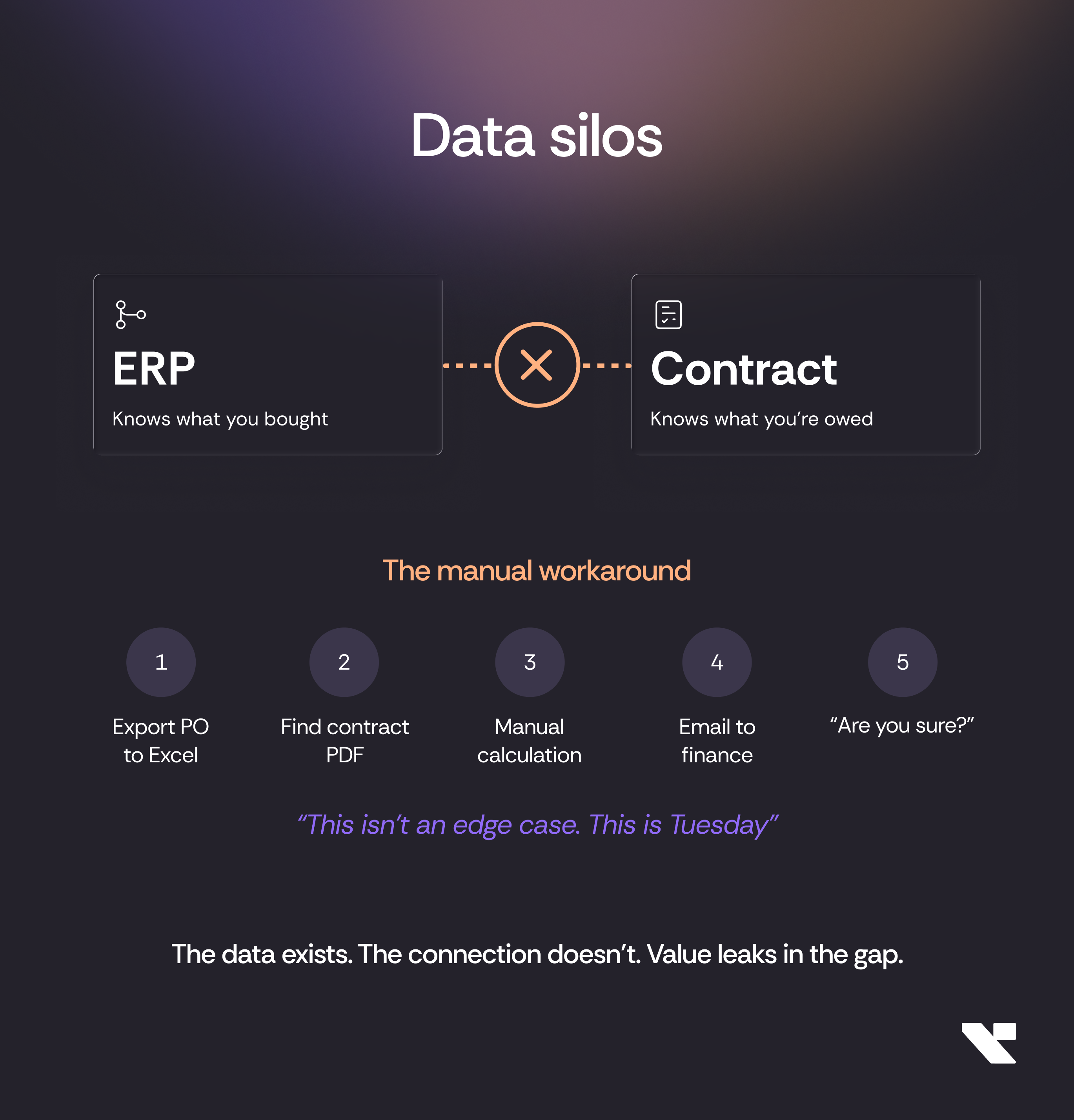

ERPs and contract systems were built for different purposes by different teams to solve different problems.

ERP systems track transactions:

- What was ordered

- What was received

- What was invoiced

- What was paid

Contract systems track agreements:

- What was negotiated

- What terms apply

- When rights expire

- Where documents are stored

Neither system was designed to answer: "Are we capturing the value we negotiated?"

According to Industry research, "Without integration, legal, finance, and procurement teams operate on separate datasets. This creates data duplication, inconsistencies, and blind spots."

The blind spot is exactly where value leaks.

The Manual Bridge: How Teams Currently Cope

Organizations don't ignore this problem - they work around it. The workaround is called "manual reconciliation."

The typical workflow:

- Export: Pull YTD purchasing data from ERP into Excel

- Search: Locate the relevant supplier contract in CLM/SharePoint

- Extract: Find the rebate terms buried in the PDF

- Calculate: Manually match purchases to threshold tiers

- Verify: Cross-reference against previous claims

- Document: Create a summary for finance review

- Submit: File the claim before the deadline

Time required: 4-8 hours per major supplier. Per quarter.

Multiply by 30 key suppliers. That's 120-240 hours per quarter - three weeks of full-time work - just to answer the question "what are we owed?"

And at the end of that process? Finance still asks "are you sure?"

Industry research highlights that "vendor, item, and PO data can drift across systems without clean interfaces, causing mismatches and manual reconciliations."

Manual reconciliation isn't a solution. It's a symptom.

Where Integration Failure Costs Money

The ERP-contract disconnect creates specific, measurable failure points.

Threshold Blindness

Your contract says: "2% rebate at €500K, 3% at €1M, 4% at €2M."

Your ERP knows you've spent €1.85M year-to-date.

But these systems don't talk. So nobody knows you're €150K away from the next tier with two months left in the year.

That's €74K in additional rebate (4% vs 3% on €1.85M) that could be captured with focused purchasing - if anyone knew to focus.

Claim Window Failures

Your contract requires rebate claims within 60 days of quarter end.

Your ERP knows how much you purchased.

Your contract system knows the deadline.

Neither system triggers an alert. Day 61 arrives. The claim window closes. The rebate is forfeited.

Price Protection Gaps

Your contract includes price protection: "If supplier increases prices more than 3%, buyer may renegotiate."

Your ERP shows unit prices increased 4.2% over 18 months.

Your contract shows you have renegotiation rights.

But nobody connected these data points. The renegotiation window expired unused.

Performance Remedy Failures

Your contract specifies: "If delivery performance falls below 95%, buyer entitled to 2% credit."

Your ERP shows on-time delivery at 91% for the past quarter.

Your contract shows you're owed credits.

But operations doesn't know the contractual threshold. Procurement doesn't see the delivery data. The credit is never claimed.

The Cost of the Gap

Let's quantify what disconnected systems actually cost.

Scenario: Manufacturing company, €40M annual supplier spend, 75 major contracts

Typical integration-gap losses:

- Missed tier thresholds: €80K-€120K annually

- Late/missed claims: €60K-€100K annually

- Unused price protections: €100K-€150K annually

- Unclaimed performance credits: €40K-€80K annually

- Manual reconciliation labor: €50K-€75K annually (in fully-loaded FTE cost)

Total annual cost of disconnection: €330K-€525K

According to World Commerce & Contracting, the average company loses 9% of contract value through poor management. A significant portion of that - estimated at 40% or more - stems specifically from the inability to connect contract terms to operational data.

The data to prevent this leakage exists. It's just sitting in systems that don't communicate.

Why 'Better ERP Utilization' Isn't the Answer

organizations without systematic tracking believe the solution is getting more out of their ERP. "We just need to use SAP better."

This misunderstands the problem.

ERPs are designed to be transactional systems of record. They excel at:

- Processing purchase orders

- Managing inventory

- Handling payments

- Generating financial reports

ERPs are not designed to:

- Store complex contract terms and conditions

- Track multi-tier incentive structures

- Monitor obligation deadlines

- Alert on contractual threshold proximity

Trying to force contract management into an ERP creates its own problems:

- Custom fields that nobody maintains

- Workaround processes that break with upgrades

- Shadow systems (spreadsheets) that proliferate anyway

Industry research notes: "Legacy systems or incompatible platforms can hinder data flow, requiring middleware or custom APIs."

The answer isn't making ERP do something it wasn't built for. The answer is connecting systems purpose-built for their respective functions.

What Integration Actually Looks Like

Effective ERP-contract integration isn't about replacing either system. It's about creating a bridge that enables both to do what they do best - together.

Automated Data Flow

Purchase data flows from ERP to contract intelligence automatically:

- Daily spend totals by supplier

- Cumulative thresholds tracked in real-time

- Delivery performance metrics linked to SLA terms

- Price changes flagged against contractual protections

Threshold Monitoring

The system knows your rebate tiers. The system knows your YTD spend. The system alerts when you're within 10% of the next tier.

No manual calculation. No quarterly reconciliation. Real-time visibility.

Proactive Alerts

Instead of discovering issues after the fact:

- "Claim window closes in 14 days - current unclaimed value: €47K"

- "Price increase triggered renegotiation rights - action required by March 31"

- "Delivery performance below SLA threshold - remedy claim available"

Unified Reporting

One view showing:

- Negotiated value vs. captured value

- Thresholds achieved vs. claimed

- Rights exercised vs. expired unused

Industry research confirms: "By integrating systems, data is shared and updated in real-time, creating a single source of information and reducing data silos."

The Business Case: Connected vs. Disconnected

Disconnected Systems:

- Manual reconciliation: 200+ hours/year

- Value leakage: 3-5% of contract value

- Data confidence: "We think so?"

- Threshold visibility: Quarterly at best

- Claim success rate: 60-70%

Connected Systems:

- Manual reconciliation: Near zero

- Value leakage: Under 1%

- Data confidence: Auditable real-time

- Threshold visibility: Continuous

- Claim success rate: 95%+

On €40M in supplier contracts:

- Disconnected: €1.2M-€2M leaked annually

- Connected: €200K-€400K leaked annually

- Delta: €1M-€1.6M recovered value

McKinsey research shows that organizations with connected contract and operational data capture 3-5% more value than those operating in silos.

The integration cost is a fraction of the leakage it prevents.

Ask Your Procurement Team This Question

How do you calculate earned incentives today?

If the answer involves:

- Excel exports

- PDF searches

- Manual calculations

- Email chains to verify numbers

You have a systems problem - not a people problem.

Your ERP knows what you bought. Your contract knows what you're owed. The connection between them is either automated or it's a tax on your team's time - and your company's bottom line.

Every hour spent on manual reconciliation is an hour not spent on strategic work.

Every missed threshold is value that was negotiated but never captured.

Every expired claim window is money that walked out the door.

The data exists. The systems exist. The only question is whether they're connected.

Are yours?