What CLM Was Built For

CLM origin story:

Legal teams drowning in contracts. Manual processes. Version chaos. Slow approvals.

CLM solution:

- Template libraries

- Clause banks

- Redlining workflows

- Approval automation

- E-signature integration

- Central repository

CLM success metric: Time from draft to signature.

This is valuable. Legal efficiency matters. But CLM was never designed to answer: "Are we capturing the value we negotiated?"

That's a different question requiring different capabilities.

The Post-Signature Gap

What happens after signature in most organizations:

- Contract uploaded to CLM repository

- Basic metadata entered (parties, dates, value)

- Expiration alert set

- Legal moves to next deal

What doesn't happen:

- Incentive terms extracted and tracked

- Thresholds monitored against spend

- Claim windows calendared

- Value capture measured

According to World Commerce & Contracting, 19% of contract value leaks through poor management. Most of that leakage occurs post-signature.

CLM solved pre-signature. The post-signature problem remains.

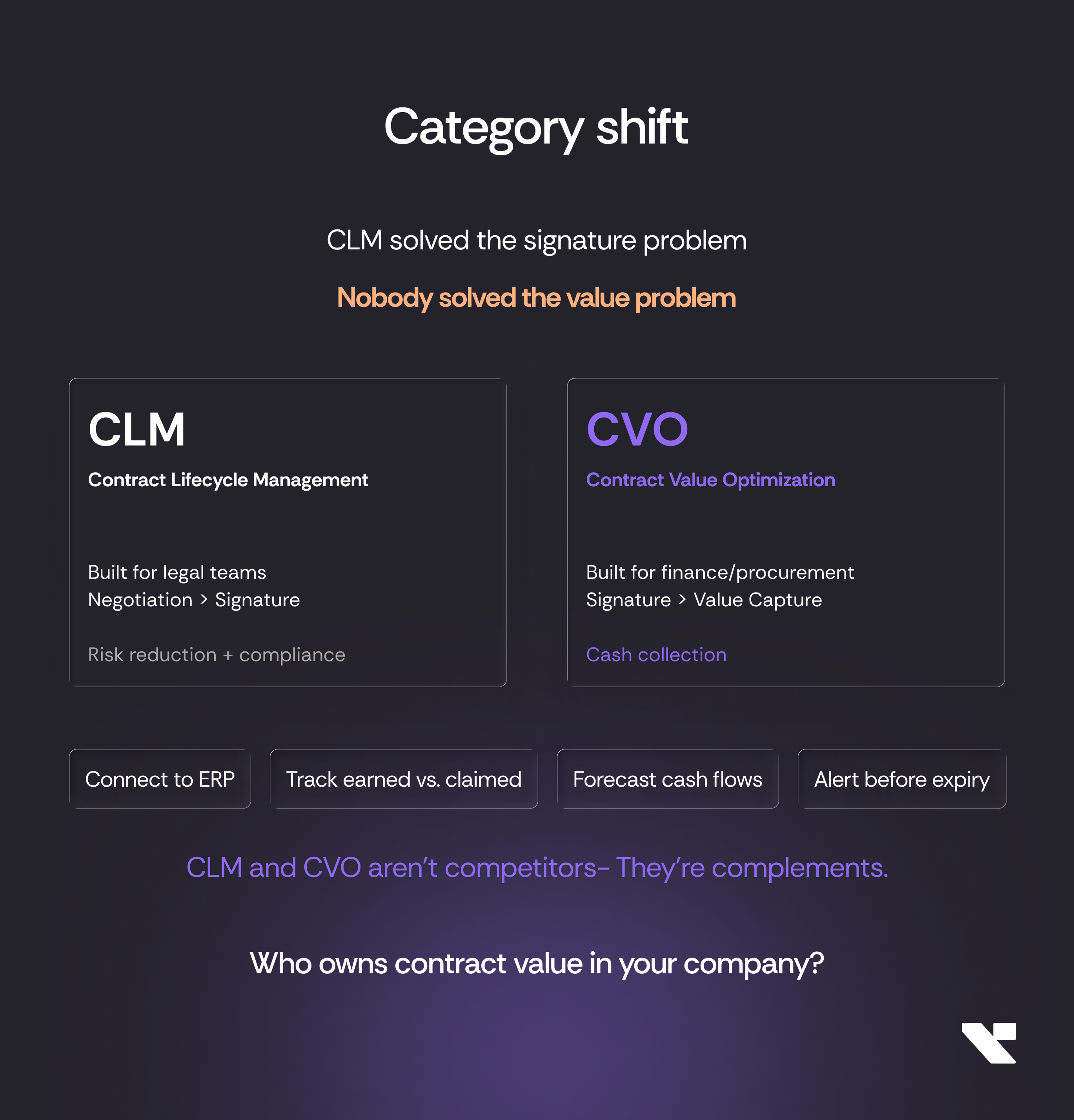

Contract Value Optimization Defined

CVO is a different category with different focus:

Different User

CLM: Legal and contract administrators

CVO: Finance, procurement, operations

Different Problem

CLM: Risk reduction, compliance, efficiency

CVO: Value capture, incentive tracking, cash optimization

Different Outcome

CLM: Compliance, audit trail

CVO: Cash collected, capture rate

Different Metrics

CLM: Contract cycle time, compliance rate

CVO: Available vs. claimed value, forecast accuracy

CVO Capabilities

Connecting contract terms to ERP transactions

Spend data linked to rebate thresholds. Automatic calculation of earned value.

Tracking earned vs. claimed value

Real-time visibility into what you're owed vs. what you've collected.

Forecasting incentive cash flows

Projected rebate income based on spend trajectory and threshold proximity.

Alerting before value expires

Proactive notifications on claim windows, approaching thresholds, expiring rights.

Portfolio-level analysis

Cross-supplier, cross-category insights. Patterns and opportunities.

According to McKinsey, organizations with these capabilities capture 3-5% more value than those without.

CLM and CVO: Complements, Not Competitors

CLM excels at:

- Contract creation and drafting

- Negotiation workflows

- Approval processes

- E-signature

- Compliance documentation

CVO excels at:

- Post-signature value tracking

- Operational data connection

- Incentive management

- Value forecasting

- Cash optimization

The ideal state:

CLM manages the document lifecycle. CVO manages the value lifecycle. Both connected, each doing what they do best.

They're not competitors. They're complements.

The Organizational Question

Who owns contract value in your company?

Legal owns the document.

Procurement owns the relationship.

Finance owns the cash.

Operations owns the performance.

But who owns the value?

In most organizations: nobody explicitly.

That's why value leaks. That's why CLM alone isn't enough.

CVO requires someone to own the answer to: "Are we capturing the value we negotiated?"

If no one owns it, that's the job description for your next hire - or your next system investment.

The Business Case: Adding CVO to CLM

Scenario: Organization with mature CLM, €40M supplier spend

Current state (CLM only):

- Contracts drafted efficiently

- Signature time reduced 40%

- Compliance excellent

- Post-signature value capture: 65%

With CVO added:

- All CLM benefits retained

- Contract terms connected to spend

- Incentives actively tracked

- Post-signature value capture: 92%

On €1.6M available incentives (4% of spend):

65% capture = €1.04M

92% capture = €1.47M

Difference: €430K annually

The Next Evolution

CLM solved the signature problem.

Contracts get created, negotiated, and signed more efficiently than ever.

The value problem remains unsolved.

Value leaks post-signature. Incentives go unclaimed. Rights expire unused.

The next evolution isn't better CLM.

It's Contract Value Optimization - a category focused on what matters most: capturing the value you negotiated.

Who owns contract value in your company?

If no one does, that's where to start.