For CFOs and Procurement leaders, this represents a critical gap in contract value management that directly impacts the bottom line.

Why Auditors Are Looking

Contract rebates have become an audit focus area for several reasons:

Materiality

For companies with significant supplier spend, rebates can represent material income. Material items require proper controls.

Complexity

Multi-tier structures with different calculation periods and conditional triggers create opportunities for errors.

Timing Issues

Rebates earned in one period, claimed in another, paid in a third. Proper cutoff and recognition matter.

Revenue Recognition Standards

ASC 606 and similar standards have increased scrutiny of variable consideration - including supplier incentives.

According to World Commerce & Contracting, contract failures are increasingly appearing in audit findings - not just as operational issues but as governance failures.

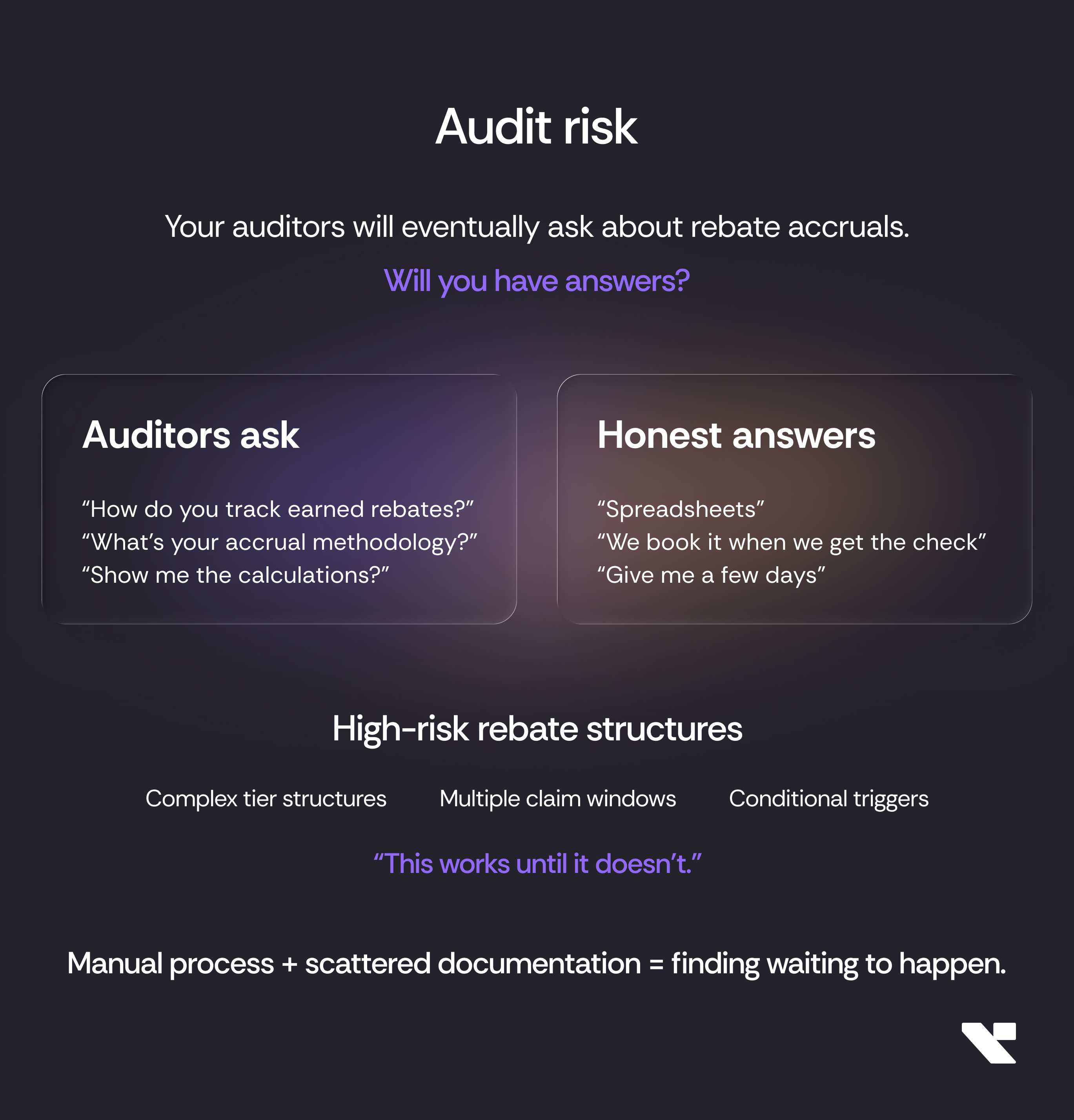

Common Audit Findings

Inconsistent Accrual Methodology

Different approaches for different suppliers. No documented policy. Estimates that can't be supported.

Missing Documentation

Calculations without supporting data. Claims without audit trail. Threshold achievements without verification.

Period Cutoff Issues

Rebates booked when received rather than when earned. Year-end recognition of value earned throughout the year.

Control Gaps

No segregation of duties. No approval workflows. No reconciliation procedures.

Contract Term Uncertainty

Inability to quickly verify what terms apply. Reliance on individual knowledge rather than documented records.

The Documentation Requirement

What auditors want to see:

For Each Claim:

- Contract reference with relevant terms highlighted

- Calculation showing how amount was derived

- Supporting data (spend reports, threshold verification)

- Approval documentation

- Claim submission record

- Payment receipt reconciliation

For Overall Process:

- Written policy for rebate recognition

- Accrual methodology documentation

- Control procedures and responsibilities

- Reconciliation processes

The question: How long would it take you to produce this documentation for your last rebate claim?

If the answer is "days," you have audit risk.

The Control Framework

Preventive Controls:

- Standardized contract term extraction

- Systematic threshold monitoring

- Documented calculation methodologies

- Approval workflows for claims

Detective Controls:

- Monthly reconciliation of claims vs. payments

- Variance analysis vs. forecast

- Period-over-period comparison

- Independent review of significant claims

Documentation Controls:

- Audit trail for all calculations

- Supporting data retention

- Approval records

- Exception documentation

According to McKinsey research, organizations with systematic contract management have significantly lower compliance risk.

The Spreadsheet Problem

Spreadsheet-based tracking creates specific audit vulnerabilities:

Version Control

Which version is authoritative? What changed between versions? Who made changes?

Formula Integrity

Are formulas correct? Have they been accidentally modified? Can they be verified?

Data Sources

Where did input data come from? Is it current? Can it be traced back?

Access Control

Who can modify the spreadsheet? Is access logged? Are changes tracked?

Auditors know these vulnerabilities. Spreadsheet-based processes automatically draw more scrutiny.

Building Audit Readiness

- Document your policy

Write down how you recognize rebates, when you accrue, how you calculate - Standardize calculations

Same methodology across suppliers. Same documentation standards. - Create audit trail

Every calculation traceable to source data and contract terms - Implement controls

Approval workflows. Reconciliation procedures. Segregation of duties. - Test regularly

Internal review of claims before external audit. Catch issues early.

Timeline: 60-90 days to establish basic audit-ready processes.

Investment: Process documentation and control implementation.

Return: Clean audits, reduced risk, better controls.

The Business Case: Risk vs. Investment

Cost of Audit Issues:

- Finding documentation: €10K-€50K in staff time

- Auditor extra work: €20K-€100K in fees

- Control weaknesses: Management attention, board questions

- Restatements: Significant if material errors found

Cost of Prevention:

- Process documentation: 40-80 hours

- Control implementation: Ongoing discipline

- System investment: Variable

The math is clear: Prevention costs a fraction of cure.

And beyond audit, good controls drive better value capture.

Pull Your Last Audit Workpaper

For rebate accruals: How long would it take to recreate that calculation from source documents?

If the answer is hours or days, that's your risk exposure.

If you don't have a workpaper for rebate accruals, that's an even bigger exposure.

Your auditors will eventually ask about rebate accruals.

Will you have answers - or a scramble?

The audit risk hiding in your vendor agreements is real. The fix isn't more spreadsheets. It's systematic tracking that auditors can follow.

Build it now. Not during audit season.