The Invisible Asset Category

Traditional accounting recognizes assets clearly:

- Cash: In the bank

- Receivables: Invoiced to customers

- Inventory: In the warehouse

- Fixed assets: On the books

But earned contract value doesn't fit neatly:

- You've earned it (purchases made, thresholds hit)

- You haven't claimed it (no invoice sent to supplier)

- It's not recognized (accounting doesn't know)

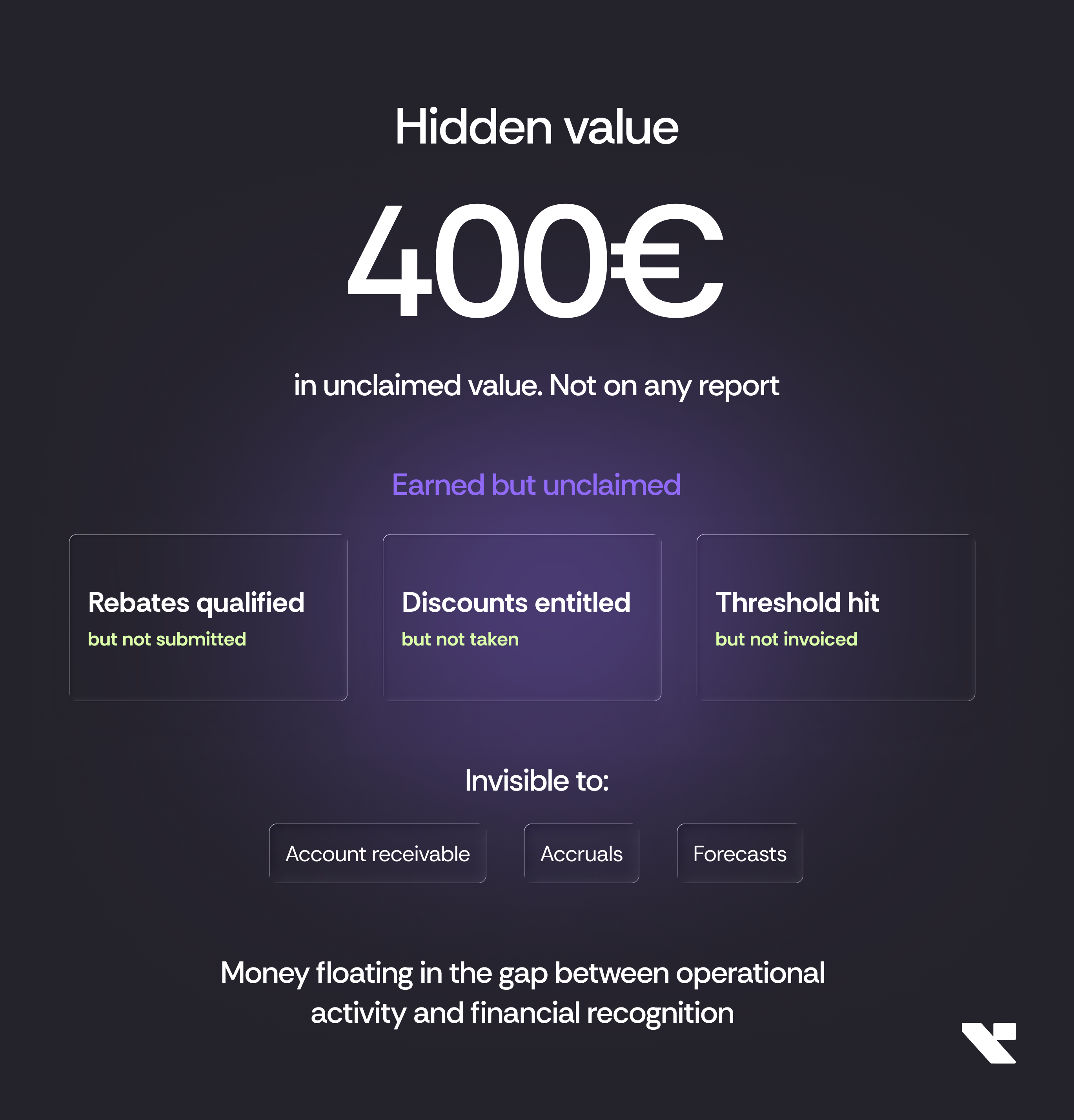

According to World Commerce & Contracting, the average company loses 9% of contract value through poor management. Much of that loss sits in this invisible category - earned but never claimed.

It's an asset that exists operationally but doesn't exist financially.

Where the Value Accumulates

Volume Rebates Earned but Unclaimed

You hit the tier in March. Claim window closes in June. It's April. €47K is sitting there, waiting.

Growth Bonuses Triggered but Undocumented

YoY growth exceeded 15%. Contract entitles you to 1% bonus. Nobody has calculated it or prepared the claim.

Early Payment Discounts Available but Not Taken

2% discount for payment in 10 days. AP is paying in 25 days. The discount exists; you're not capturing it.

Performance Credits Due but Not Invoiced

Supplier SLA fell below 95%. Contract entitles you to 2% credit. Operations knows. Finance doesn't. No claim filed.

Each of these is real value. Each is invisible to the balance sheet.

Why Finance Doesn't See It

The invisibility isn't accidental. It's structural.

No System of Record

ERP tracks purchases. CLM stores contracts. Nothing tracks "earned value pending claim."

Cross-Functional Gap

Procurement knows the contract terms. Finance knows the payments. Operations knows the performance. Nobody has the complete picture.

Accrual Uncertainty

GAAP says you should accrue earned rebates. But you can only accrue what you can quantify. If you can't track it, you can't accrue it.

PwC research shows 90% of professionals struggle to locate contracts when needed. If you can't find the contract, you can't calculate the earned value.

The Quantification Challenge

Calculating earned-but-unclaimed value requires connecting multiple data sources:

- Contract terms: What incentives are available? What are the thresholds?

- Purchase data: What have you bought? From which suppliers? In which categories?

- Claim history: What have you already submitted? What's been paid?

- Timing: What claim windows are open? When do they close?

The calculation:

Available incentives (based on contract terms)

- Already claimed (based on submission records)

- Already paid (based on payment records)

= Earned but unclaimed value

This calculation should be automatic. In most organizations, it's impossible without days of manual work.

The Financial Implications

For the P&L:

Unclaimed value is margin you've earned but won't receive. It shows up as lower profitability - without anyone knowing why.

For the Balance Sheet:

If you should be accruing earned rebates but aren't, your assets are understated and your expenses are overstated.

For Cash Flow:

Value that isn't claimed is cash that never arrives. Working capital suffers.

For Forecasting:

If you don't know what you've earned, you can't forecast what you'll collect. Variance becomes unpredictable.

According to McKinsey research, organizations with systematic contract tracking capture 3-5% more value - much of that from making invisible value visible.

Making the Invisible Visible

Step 1: Inventory All Incentive Mechanisms

- Extract incentive terms from all major contracts

- Catalogue thresholds, claim windows, documentation requirements

Step 2: Calculate Current Position

- Pull YTD spend by supplier

- Map against contract thresholds

- Identify earned-but-unclaimed status

Step 3: Establish Tracking System

- Connect contract terms to purchase data

- Automate threshold monitoring

- Create claim alerts and workflows

Step 4: Report to Finance

- Monthly earned-but-unclaimed value report

- Claim pipeline and timing

- Accrual recommendations

The Business Case: Visible vs. Invisible

Scenario: €25M supplier spend, standard incentive structures

Invisible Approach:

- Earned-but-unclaimed value: Unknown

- Typical amount sitting unclaimed: €300K-€400K

- Claim rate: 60-70%

- Annual leakage: €180K-€240K

Visible Approach:

- Earned-but-unclaimed value: Known and reported monthly

- Amount sitting unclaimed: Never exceeds €50K (claims submitted promptly)

- Claim rate: 90-95%

- Annual capture improvement: €150K-€200K

Making invisible value visible doesn't just improve reporting. It drives action that captures real money.

Ask Your Procurement Team This Question

What's our current earned-but-unclaimed value?

If they can answer with a specific number and breakdown by supplier: You have visibility.

If they need to research for days to estimate: You have invisible value leaking.

If they don't understand the question: You have a significant gap.

Your contracts have €400K in unclaimed value. It's not on any report.

Find it. Claim it. Make it visible.

Because invisible value is value you're losing - every single day.